Do You Need A Financial Advisor?

If you do your own investing, have you ever wondered whether you should turn things over to a professional advisor? This article attempts to shed some light on this topic and provide you with some things to think about so you can make the best decision.

When the Time Comes

Professional advisors say there is no magic asset number that pushes an investor to seek advice. Rather, it is more likely an event that spooks a person and sends him scurrying through an advisor door. The event could be something that requires the individual to manage an asset himself.

Judging Yourself

The need for critical self-evaluation is vital when determining whether to hire a financial planner. Advisors say the decision depends on the investor.

The following questions should help you sort out whether you need an advisor:

• Do you enjoy reading about investments and doing research?

• Do you have expertise in investments? Do you have the time to monitor, evaluate them and make periodic changes to your portfolio?

Not So Fast

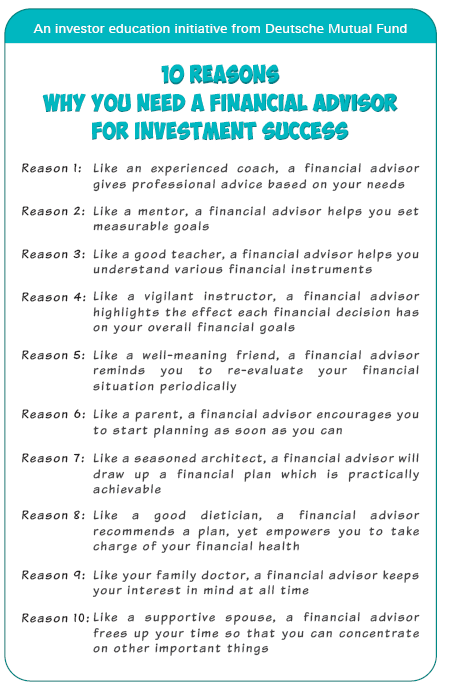

However, Loren Dunton, one of the founders of the financial planning movement, says that many people who believe they do not need a financial planner could benefit from one anyway.

Finding the Right Financial Professional

How should you go about finding the right advisor? Begin by asking for referrals from colleagues, friends or family members who seem to be managing their finances successfully. Another avenue is professional recommendations. A CA or a lawyer might make a referral. Professional associations can sometimes provide help.

The Wrong Advisor

If your advisor only records some transactions from time to time but never sits down and discusses long-term goals with you, you may want to look for a new advisor. Similarly, if your advisor never writes an investment plan to lay out your goals and assess whether they are being reached, you may be better served elsewhere.

Finally, the individual should ensure that any financial professional has the proper credentials. Avoid any advisor who is little more than a broker but calls himself a financial planner or advisor.

Many planners or advisors only sell financial products. In fact, the term financial planner has been a much-abused term. A person can label himself or herself as a financial planner, but not be a SEBI Registered Investment Advisor unless he or she has fulfilled the necessary credentials. Therefore, do not allow yourself to be impressed by the title on an advisor business card until you understand what qualifications and certifications he or she actually has.

The Bottom Line

The decision about whether to seek advice can be critical. If you do choose to seek advice, carefully choose the right professional for the job, and you should be on your way to a better financial plan. If you decide to go it alone, remember if at first you do not succeed, you can try again … or call an advisor.